UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒x

Filed by a Party other than the Registrant ☐o

Check the appropriate box:

☐

Preliminary Proxy Statement

|

| |

o | Preliminary Proxy Statement |

| |

o | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

x | Definitive Proxy Statement |

| |

o | Definitive Additional Materials |

| |

o | Soliciting Material Pursuant to Section 240.14a-12 |

☐

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material Pursuant to Section 240.14a-12

SMITH-MIDLAND CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

x | No fee required |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

(1) | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

(1)

Title of each class of securities to which transaction applies:

|

| |

o | Fee paid previously with preliminary materials. |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount Previously Paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

SMITH-MIDLAND CORPORATION

5119 Catlett Road

Midland, Virginia 22728

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on Tuesday, August 14, 2018Wednesday, June 23, 2021

Dear Stockholders:

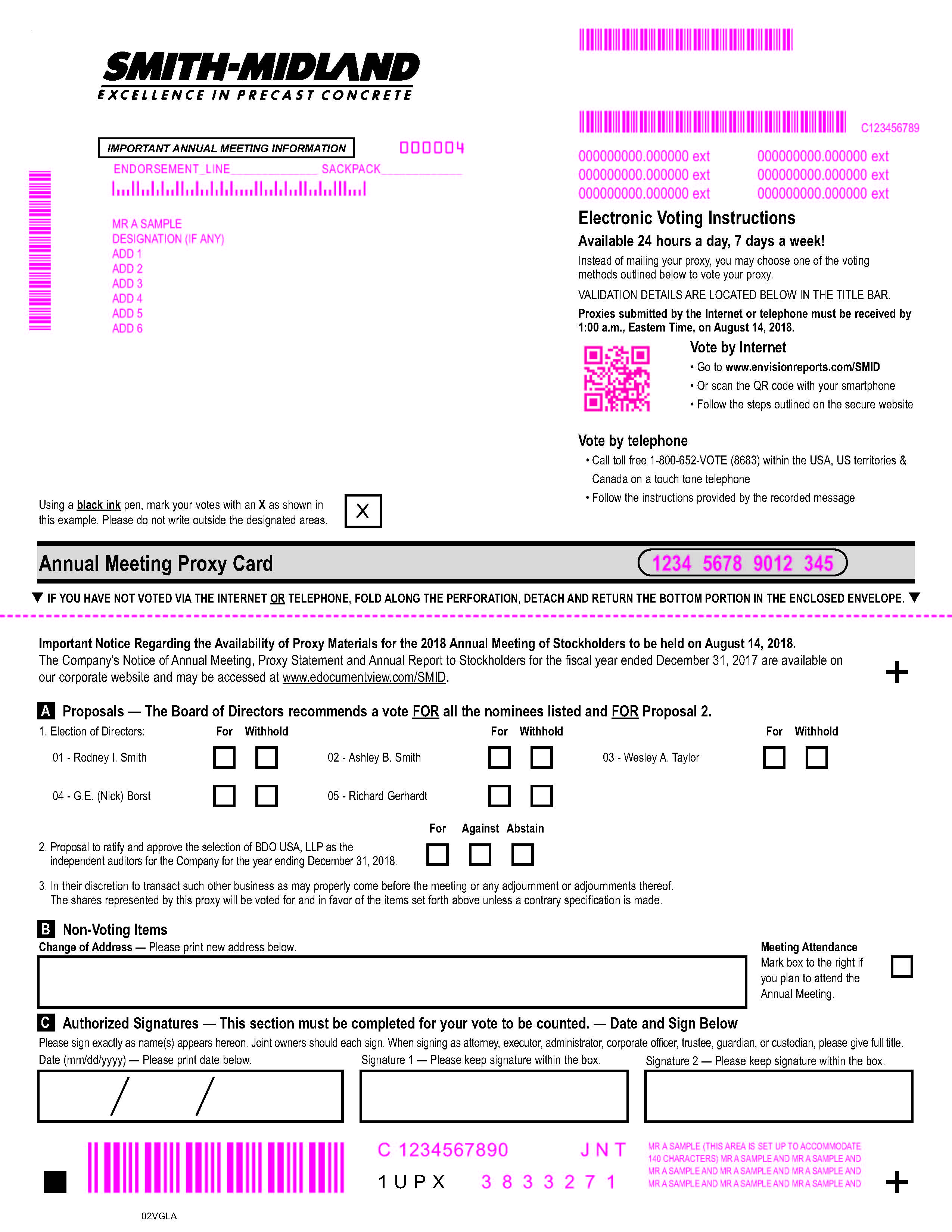

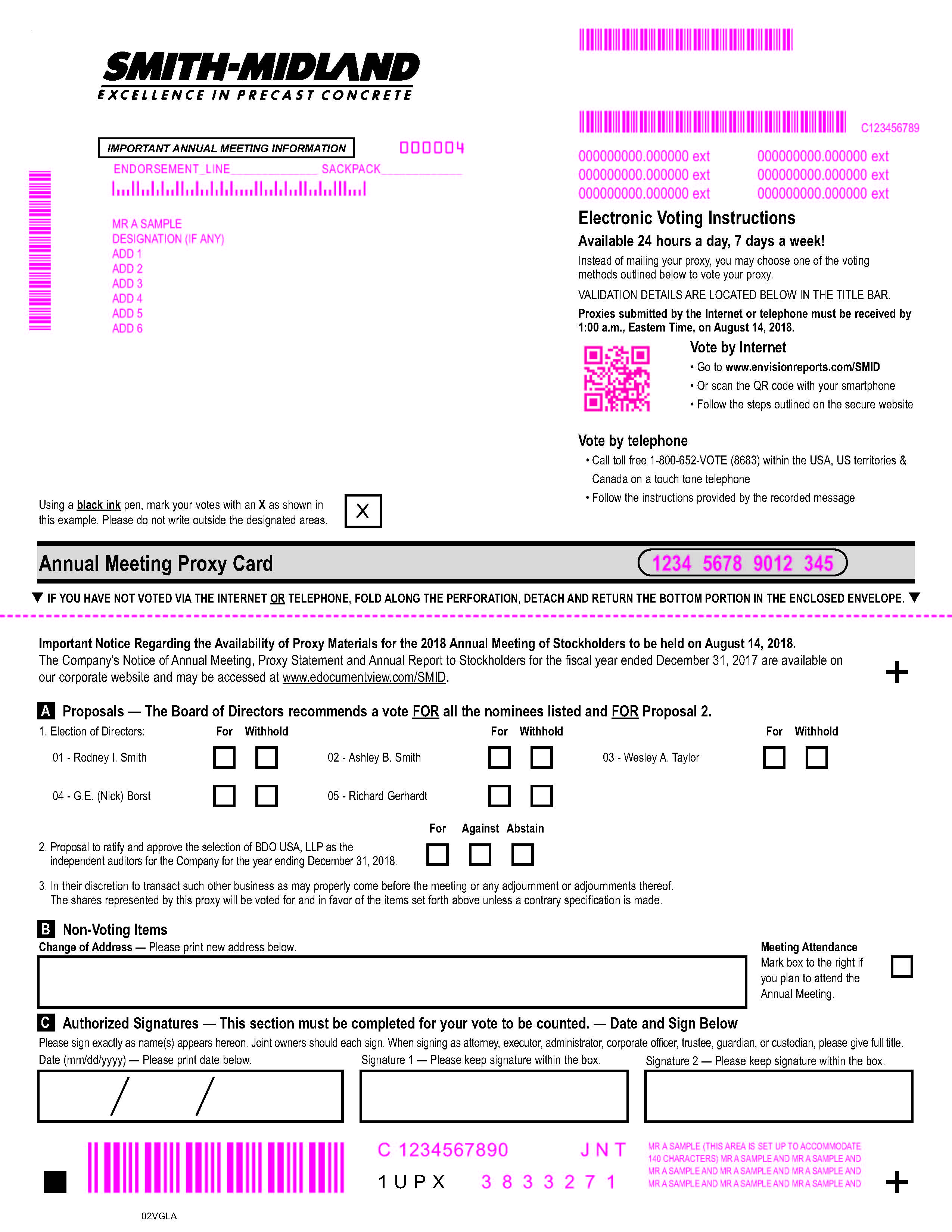

You are cordially invited to attend the 20182021 Annual Meeting of Stockholders of SMITH-MIDLAND CORPORATION (the “Company”), a Delaware corporation, to be held at Smith-Midland CorporationWarrenton-Fauquier Airport Terminal located at 5119 Catlett Road,1533 Iris Trail, Midland, Virginia 22728 on Tuesday, August 14, 2018Wednesday, June 23, 2021 at 5:4:00 p.m. local time. The annual meetingAnnual Meeting is being held for the following purposes:

| |

| 1. | To elect five (5) members to the Board of Directors; |

| |

| 2. | To ratify the appointment of the accounting firm BDO USA, LLP as the Company’s Independent Registered Public Accountants for the current year ending December 31, 2018; and2021;

|

| |

| 3. | To consider and act upon any matters incidental to the foregoing and any other matters that may properly come before the meeting or any and all adjournments thereof. |

The Board of Directors has fixed the close of business on June 25, 2018April 26, 2021 as the record date for the determination of Stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or adjournments thereof. The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

We hope that all stockholders will be able to attend the Annual Meeting in person. In order to assure that a quorum is present at the Annual Meeting, please date, sign and promptly return the enclosed proxy card promptly in the accompanying postage prepaid envelope if you received this Proxy Statement in the mail, or follow the instructions contained in the Notice of Internet Availability of Proxy Materials to vote on the Internet whether or not you expect to attend the Annual Meeting. A prepaid postage envelope has been enclosed for your convenience. If you attend the Annual Meeting, your proxy will, at your request, be returned to you and you may vote your shares in person.

|

| | |

| | By Order of the Board of Directors | |

| | | |

| | | |

| | Rodney I. Smith | |

| | Chairman | |

| | | |

| | Midland, Virginia | |

| | July 10, 2018May 7, 2021

| |

Important Notice Regarding the Internet Availability of Proxy Materials for the 20182021 Annual Meeting of Stockholders to be held on August 14, 2018.June 23, 2021. Pursuant to Securities and Exchange Commission rules we have elected to utilize the "full set delivery""notice and access" option of providing paperelectronic copies of all of our proxy materials, including a proxy card, to our stockholders, as well as providing access to our proxy materials on a publicly assessableaccessible website. The Company's Notice of Annual Meeting, Proxy Statement and Annual Report to Stockholders for the fiscal year ended December 31, 20172020 are available on our corporate websitethe Internet and may be accessed at www.edocumentview.com/https://www.iproxydirect.com/SMID.

SMITH-MIDLAND CORPORATION

5119 Catlett Road

Midland, Virginia 22728

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of SMITH-MIDLAND CORPORATION (the “Company”) for use at the Annual Meeting of Stockholders (the "Annual Meeting") to be held on Tuesday, August 14, 2018,Wednesday, June 23, 2021, at 5:4:00 p.m. local time at Smith-Midland CorporationWarrenton-Fauquier Airport Terminal located at 5119 Catlett Road,1533 Iris Trail, Midland, Virginia 22728 and at any adjournment or adjournments thereof.

These proxy solicitation materials are first being mailedsent to stockholders of record on or about JulyMay 10, 2018,2021, together with the Company’s Annual Report to Stockholders.

This proxy statement, form of proxy and the annual report are available at: http:https://www.edocumentview.com/www.iproxydirect.com/SMID

Stockholders of record at the close of business on June 25, 2018April 26, 2021 will be entitled to vote at the Annual Meeting or any adjournment thereof. On or about the record date, 5,080,3955,202,515 shares of the Company’s common stock, $.01 par value per share (“Common Stock”), were issued and outstanding. The Company has no other outstanding voting securities.

Each share of Common Stock entitles the holder to one vote with respect to all matters submitted to Stockholders at the Annual Meeting. A quorum for the Annual Meeting is a majority of the shares outstanding. Abstentions and broker non-votes are each included in the determination of the number of shares present and voting for the purpose of determining whether a quorum is present. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker does not receive voting instructions from the beneficial owner and (2) the broker lacks discretionary authority to vote the shares. Brokers are prohibited from exercising discretionary authority on non-routine matters. Proposal one is considered a non-routine matter and, therefore, brokers cannot exercise discretionary authority regarding this proposal for beneficial owners who have not returned proxies to the brokers.

Abstentions or broker non-votes or failures to vote will have no effect in the election of directors, who will be elected by a plurality of the affirmative votes cast.

The affirmative vote of the holders of a majority of the shares present in person or by proxy and entitled to vote to ratify the appointment of BDO USA, LLP as the Company’s independent auditors for the year ending December 31, 20182021 will be required for approval. An abstention will be counted as a vote against this proposal.

An Annual Report, containing the Company’s audited financial statements for the years ended December 31, 20172020 and December 31, 2016,2019, is being mailedavailable online at https://www.iproxydirect.com/SMID to all Stockholders entitled to vote.

Execution of a proxy will not in any way affect a Stockholder’s right to attend the Annual Meeting and vote in person. The proxy may be revoked at any time before it is exercised by written notice to the Company's Secretary prior to the Annual Meeting, or by giving to the Secretarysubmitting a duly executed proxy bearing a later date than the proxy being revoked at any time before such proxy is voted, or by appearing at the Annual Meeting and voting in person. The shares represented by all properly executed proxies received in time for the Annual Meeting will be voted as specified therein. Proxies that are signed and returned but do not include voting instructions shares will be voted in favor of the election of Directors of those persons named in this Proxy Statement and in favor of the proposal to ratify and approve the selection of BDO USA, LLP as the independent auditors for the Company for the year ending December 31, 2018.2021.

The Board of Directors knows of no other matter to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote may be taken, such shares represented by all proxies received by the Board of Directors will be voted with respect thereto in accordance with the judgment of the persons named as attorneys in the proxies. The Board of Directors knows of no matter to be acted upon at the Annual Meeting that would give rise to appraisal rights for dissenting stockholders.

Proposal No. 1

ELECTION OF DIRECTORS

Five Directors, constituting the entire Board of Directors, are to be elected at the Annual Meeting. Each Director of the Company is elected at the Company’s Annual Meeting of Stockholders and serves until his successor is elected and qualified. Vacancies and newly created directorships resulting from any increase in the number of authorized Directors may be filled by a majority vote of Directors then remaining in office. Officers are elected by and serve at the discretion of the Board of Directors.

Shares represented by all proxies received by the Board of Directors and not so marked as to withhold authority to vote for an individual Director, or for all Directors, will be voted (unless one or more nominees are unable or unwilling to serve) for the election of the nominees named below. The Board of Directors knows of no reason why any such nominee should be unwilling to serve, but if such should be the case, proxies will be voted for the election of some other person or for fixing the number of Directors at a lesser number.

The Board unanimously recommends that Stockholders voteFORelection of the five nominees for Director.

The following table sets forth certain information concerning each nominee for election as a Director of the Company:

| | | Name | | Age | | Director Since | | Position | | Age | | Director Since | | Position |

| Rodney I. Smith | | 79 | | 1970 | | Chairman of the Board of Directors | | 82

| | 1970 | | Chairman of the Board of Directors |

| Ashley B. Smith | | 55 | | 1994 | | Chief Executive Officer, President, and Director | | 59

| | 1994 | | Chief Executive Officer, President, and Director |

| Wesley A. Taylor | | 70 | | 1994 | | Director | | 73

| | 1994 | | Director |

| G. E. Borst | | 77 | | 2013 | | Director | |

| Richard Gerhardt | | 51 | | 2016 | | Director | | 54

| | 2016 | | Director |

James Russell Bruner

| | | 65

| | 2018 | | Director |

Background

The following is a brief summary of the background of each nominee for Director of the Company:

Rodney I. Smith.Chairman of the Board of Directors.Rodney I. Smith co-founded the Company in 1960 and became its President and Chief Executive Officer in 1965. He served as President until 20142012 and Chief Executive Officer until May 2018. Mr. Smith currently remains as an employee of the Company. He has served on the Board of Directors and has been its Chairman since 1970. Mr. Smith is the principal developer and inventor of the Company’s proprietary and patented products. He is the past President of the National Precast Concrete Association. Mr. Smith has served on the Board of Trustees of Bridgewater College in Bridgewater, Virginia since 1986. The Company believes that Mr. Smith’s extensive experience in the precast concrete products industry and his knowledge of the marketplace gives him the qualifications and skills necessary to serve in the capacity as the Chairman of the Board of Directors.

Ashley B. Smith. Chief Executive Officer, President, and Director.Ashley B. Smith has served as Chief Executive Officer of the Company since May 2018, President of the Company since 20142012, and as a Director since 1994. HeMr. Smith was Vice President of the Company from 1990 to 2014.2011. He is the past Chairman of the National Precast Concrete Association. Mr. Smith serves on the Board of Trustees of Bridgewater College in Bridgewater, Virginia. Mr. Smith holds a Bachelor of Science degree in Business Administration from Bridgewater College. He is currently President of the National Precast Concrete Association. Mr. Ashley B. Smith is the son of Mr. Rodney I. Smith. The Company believes that Mr. Smith’s education, experience in the precast concrete industry and business experience give him the qualifications and skills necessary to serve in the capacity as a director.

Wesley A. Taylor.Director. Wesley A. Taylor served as Vice President of Administration of the Company from 1989 until January 2017 and has served as a Director since 1994, and previously held the position as Vice President of Administration from 1989 to 2017.1994. Mr. Taylor holds a Bachelor of Arts degree from Northwestern State University. The Company believes that Mr. Taylor’s education, business experience and his extensive experience in the precast concrete industry gives him the qualifications and skills necessary to serve in the capacity as a director.

G. E. Borst. Richard Gerhardt.Director. G.E. (Nick) BorstMr. Gerhardt has served as a Director of the Company since 2013 and previously as an advisory member of the Board of Directors since 2005. Mr. Borst is a retired Virginia attorney. He is a past president of the Fauquier County Bar Association and three-term treasurer of the Fauquier County Chamber of Commerce. In private law practice Mr. Borst advised clients on business organization and governance. Mr. Borst is co-founder and past president of Hospice of

Fauquier County, a volunteer organization. He helped establish and has been a long term board member of Verdun Adventure Bound, a 501(C)(3) organization that provides experiential learning programs to over 2,500 young people a year. The Company believes that Mr. Borst’s current and past business-related experience provides him with the knowledge and skills necessary to serve in the capacity as a director of the Company.

Richard Gerhardt. Director.Mr. Gerhardt has served as a Director of the Company since 2016. In 2016, he servedHe is currently President of Sales Services International, Inc., a consulting firm, and Chief Sales Officer for IMEX Global Solutions, Inc., a logistics company, since April 2019, and is also serving as Chief Operating Officer of Old Dominion Spirits Corporation in Warrenton, Virginia.a Fauquier County, Virginia Supervisor for the Cedar Run Magisterial District since January 2016. From 2003 to 2014, Mr. Gerhardt served in an escalating succession of positions for three global shipping and logistic companies: DHL Global Mail, ESI Global Logistic and MSI Worldwide. His eight years as President, Chief Operating Officer, and Shareholdershareholder of MSI Worldwide culminated in its acquisition by Belgian Post. Mr. Gerhardt currently serving his first term as a Fauquier County, Virginia Supervisor for the Cedar Run Magisterial District. Mr. Gerhardt presently serves on the boards of Path Foundation (formally Fauquier Health Foundation), Virginia Gold Cup Association and Fauquier Free Clinic. Mr. Gerhardt holds a Bachelor of Arts in Business Administration with a minor in Economics from Washington College in Chestertown, MD.Maryland. The Company believes that Mr. Gerhardt's current and past business-related experience provides him with the knowledge and skills necessary to serve in business operations, management, strategic planningthe capacity as a director of the Company.

James Russell Bruner.Director. Mr. Bruner has served as a member of the Board of Directors of the Company since December 2018.Mr. Bruner has served as Chairman of Maersk Line, Limited (“Maersk Line”) since November 2016 and leadershipwas President and Chief Executive Officer of Maersk Line from January 2014 to November 2017. Maersk Line owns and operates a fleet of container and tanker ships that are under the flag of the United States. These ships support military, government and humanitarian missions through the transportation of United States government cargo on an international basis. Maersk Line operates as a subsidiary of A.P. Moller-Maersk A/S, an integrated transport and logistics company headquartered in Copenhagen, Denmark. Mr. Bruner attended Bridgewater College in Virginia. He is a graduate of the University of Michigan Executive Program and Harvard Business School's Advanced Management Program.The Company believes that Mr. Bruner's current and past business-related experience provides him with the knowledge and skills necessary to serve in the capacity as a director of the Company.

GENERAL INFORMATION RELATING TO THE BOARD OF DIRECTORS AND OFFICERS

Director Independence

Currently G.E. Borst and Richard Gerhardt, James Russell Bruner, and Wesley A. Taylor are the only independent directors of the Company as determined under the NASDAQ Marketplace Rules. The other Directors are not considered independent in view of their positions as current or recent executive officers of the Company.

Meetings and Committees of the Board of Directors

The Board of Directors does not have standing Compensation, Nominating, or Audit Committees or any committees performing similar functions at the current time. The Board of Directors has authorized the formation of the Audit and Compensation Committees and anticipates that it will shortly constitute those committees with G.E. Borst and Richard Gerhardt, and adopt committee charters.

Currently, compensation of executive officers, board advisers and directors of the Company, including, but not limited to, the grant of restricted stock pursuant to the 2016 Stock Incentive Plan or other plan which may be established, is decided by the Board of Directors as a whole.

The Company does not have a standing Nominating Committee at the current time. The Company believes that a standing Nominating Committee is not necessary or cost efficient for a company its size. All directors participate in the consideration of director nominees. The Company does not have a formal Nominating Committee Charter. While the Board of Directors has received a small number of stockholder recommendations for consideration of director candidates, it has not received a sufficient amount to warrant the adoption of a formal policy in that regard, although it may consider doing so in the future. It is the Board’s intent to consider any stockholder nominees that may be put forth. The Board has not identified any specific minimum qualifications or skills that it believes must be met by a nominee for director. It is the intent of the Board to review from time to time the appropriate skills and characteristics of directors in the context of the current make-up of the Board and the requirements and needs of the Company at a given time.

In selecting nominees for the Board, the Company considers the diversity of each candidate in regards to the anticipated needs of the Company as a whole so as to leverage the experience and education of each director in achieving the goals of the Company.

The Board of Directors met formally three times during 20172020 and met informally on a number of occasions, voting on corporate actions, in some cases, by written consent. All of the Company’s current directors attended all of the meetings of the Board of Directors in person except for Richard Gerhardt and Wesley A. Taylor who each missed one meeting during 2017.the respective committees of which they are members.

With the exception of Rodney I. Smith and Ashley B. Smith, who are father and son, respectively, no Director or executive officer of the Company is related by blood, marriage, or adoption to any of the Company’s other Directors or executive officers. There are no related-party transactions required to be disclosed pursuant to Item 404 of Regulation S-K.

AuditNominating and Governance Committee

The Company does not havecreated a standing AuditNominating and Governance Committee the entire Board of Directors has functioned as the Audit Committee. As previously stated,in April, 2020. The Nominating and Governance Committee operates under a written charter adopted by the Board of Directors and the charter is available without charge on our website atwww.smithmidland.comunder the heading “Investors/Governance Docs”. Hard copies may also be obtained, without charge, by writing to our Secretary at Smith-Midland Corporation at 5119 Catlett Road, Midland, Virginia 22728. The Nominating and Governance Committee held three meetings during the fiscal year ended December 31, 2020.

As of the record date, the members of the Nominating and Governance Committee consisted of Richard Gerhardt and James Russell Bruner. All of the members of the Nominating and Governance Committee have been determined to meet the applicable NASDAQ Marketplace and SEC rules for independence. The purpose of the Nominating and Governance Committee is to identify, screen and recommend to the Board qualified candidates to serve as directors, to develop and recommend to the Board a set of corporate governance principles applicable to the Company, and to oversee corporate governance and other organizational matters. The Nominating and Governance Committee’s responsibilities include, among other things:

●

reviewing qualified candidates to serve as directors;

●

aiding in attracting qualified candidates to serve on the Board;

●

considering, reviewing and investigating (including with respect to potential conflicts of interest of prospective candidates) and either accepting or rejecting candidates suggested by stockholders, directors, officers, employees and others;

●

recommending to the Board nominees for new or vacant positions on the Board and providing profiles of the qualifications of the candidates;

●

monitoring our overall corporate governance and corporate compliance program;

●

reviewing and adopting policies governing the qualification and composition of the Board of Directors;

●

reviewing and making recommendations to the Board regarding Board structure, including establishing criteria for committee membership, recommending processes for new Board member orientation, and reviewing and monitoring the performance of incumbent directors;

●

recommending to the Board action with respect to implementing resignation, retention and retirement policies of the Board;

●

reviewing the role and effectiveness of the Board, the respective Board committees and the directors in our corporate governance process; and

●

reviewing and making recommendations to the Board regarding the nature and duties of Board committees, including evaluating the committee charters, recommending appointments to committees, and recommending the appropriate chairperson for the Board.

Director Nomination Procedures

The Nominating and Governance Committee will consider individuals recommended by stockholders for nomination as candidates for election to the Board at annual meetings of stockholders. Such suggested nominees will be considered in the context of the Nominating and Governance Committee’s determination regarding all issues relating to the composition of the Board, including the size of the Board, any criteria the Nominating and Governance Committee may develop for prospective Board candidates and the qualifications of candidates relative to any such criteria. The Nominating and Governance Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. Any stockholder who wants to nominate a candidate for election to the Board must deliver timely notice to our Secretary at Smith-Midland Corporation at 5119 Catlett Road, Midland, Virginia 22728. In order to be timely, the notice must be delivered:

●

in the case of an annual meeting, not less than 60 days nor more than 90 days prior to the anniversary date of the immediately preceding annual meeting of stockholders, although if the annual meeting is more than 30 days before or more than 60 days after such anniversary date, the notice must be received not less than 60 days nor more than 90 days prior to the date of such annual meeting or the 10thday following the date public disclosure of the annual meeting was made; and

●

in the case of a special meeting, not less than 60 days nor more than 90 days prior to the date of such special meeting or the 10thday following the date public disclosure of the special meeting was made.

The stockholder’s notice to the Secretary must set forth:

●

as to each person whom the stockholder proposes to nominate for election as a director

o

the nominee’s name, age, business address and residence address;

o

the nominee’s principal occupation and employment;

o

the class and series and number of shares of each class and series of capital stock of the Company which are owned beneficially or of record by the nominee, and any other direct or indirect pecuniary or economic interest in any capital stock of the Company held by the nominee, including without limitation, any derivative instrument, swap (including total return swaps), option, warrant, short interest, hedge or profit sharing arrangement, and the length of time that such interest has been held by the nominee; and

o

any other information relating to the nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Securities and Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

●

as to the stockholder giving the notice

o

the stockholder’s name and record address;

o

the class and series and number of shares of each class and series of capital stock of the Company which are owned beneficially or of record by the stockholder, and any other direct or indirect pecuniary or economic interest in any capital stock of the Company held by the stockholder, including without limitation, any derivative instrument, swap (including total return swaps), option, warrant, short interest, hedge or profit sharing arrangement, and the length of time that such interest has been held by the stockholder; and

o

any other information relating to the stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to section 14 of the Securities and Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

The notice delivered by a stockholder must be accompanied by a written consent of each proposed nominee to be named as a nominee and to serve as a director if elected. The stockholder must be a stockholder of record on the date on which the stockholder gives the notice described above and on the record date for the determination of stockholders entitled to vote at the meeting.

The Nominating and Governance Committee will consider certain minimum qualifications for serving as a director including that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and have an impeccable record and reputation for honesty and ethical conduct in both his or her professional and personal activities. In addition, the Nominating and Governance Committee will examine a candidate’s specific experiences and skills, relevant industry background and knowledge, time availability in light of other commitments, potential conflicts of interest, interpersonal skills and compatibility with the Board, and independence from management and the Company. The Nominating and Governance Committee will also seek to have the Board represent a diversity of backgrounds in regards to the anticipated needs of the Company as a whole so as to leverage the experience and education of each director in achieving the goals of the Company. The Nominating and Governance Committee will not assign specific weights to particular criteria and no particular criterion will necessarily be applicable to all prospective nominees. The Nominating and Governance Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

The Nominating and Governance Committee will identify potential nominees through independent research and through consultation with current directors and executive officers and other professional colleagues. The Nominating and Governance Committee will look for persons meeting the criteria above and take note of individuals who have had a change in circumstances that might make them available to serve on the Board, for example, retirement as a Chief Executive Officer or Chief Financial Officer of a company. The Nominating and Governance Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described above, the Nominating and Governance Committee will also consider candidates recommended by stockholders.

Once a person has been identified by the Nominating and Governance Committee as a potential candidate, the committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating and Governance Committee determines that the candidate warrants further consideration by the committee, the Chairman or another member of the committee will contact the person. If the person expresses a willingness to be considered and to serve on the Board, the Nominating and Governance Committee will request a resume and other information from the candidate, review the person’s accomplishments and qualifications, including in light of any other candidates that the committee might be considering. The Nominating and Governance Committee may also conduct one or more interviews with the candidate, either in person, telephonically or both. In certain instances, Nominating and Governance Committee members may conduct a background check, may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Nominating and Governance Committee’s evaluation process will not vary based on whether a candidate is recommended by a stockholder, although, as stated above, the committee may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Compensation Committee

The Compensation Committee operates under a written charter adopted by the Board of Directors and the charter is available without charge on our website atwww.smithmidland.comunder the heading “Investors/Governance Docs”. Hard copies may also be obtained, without charge, by writing to our Secretary at Smith-Midland Corporation at 5119 Catlett Road, Midland, Virginia 22728. The Compensation Committee reviews and assesses the adequacy of its charter annually. The Compensation Committee held three meetings during the fiscal year ended December 31, 2020.

As ofthefiscal year endedDecember 31,2020 and as of the record date, the members of the Compensation Committee consisted of Richard Gerhardt, James Russell Bruner, and Wesley A. Taylor. Each member of the Compensation Committee has been determined by the Board, which will be reviewed on an annual basis, to meet the standards for independence required of compensation committee members by NASDAQ Marketplace and applicable SEC rules.

The Compensation Committee assists the Board in determining the compensation of the Company’s executive officers, board advisers, and directors of the Company, including but not limited to, the grant of restricted stock pursuant to the 2016 Stock Incentive Plan or other plan that may be established. The Compensation Committee’s principal responsibilities, which have been authorized formationby the Board, are:

●

approving the corporate goals and objectives applicable to the compensation for the Chief Executive Officer, evaluating at least annually the Chief Executive Officer’s performance in light of those goals and objectives and determining and approving the Chief Executive Officer’s compensation level based on this evaluation;

●

reviewing and approving other executive officers’ annual base salaries and annual incentive opportunities (after considering the recommendation of our Chief Executive Officer with respect to the form and amount of compensation for executive officers other than the Chief Executive Officer);

●

evaluating the level and form of compensation for Board of Directors and committee service by non-employee members of our Board and recommending changes when appropriate;

●

advising the Board on compensation and benefits matters, including making recommendations and decisions where authority has been granted regarding our equity-based compensation plans and benefit plans generally, including employee bonus and retirement plans and programs;

●

approving the amount of and vesting of equity awards;

●

evaluating the need for, and provisions of, any employment contracts/severance arrangements for the Chief Executive Officer and other executive officers; and

●

reviewing and discussing with management our disclosure relating to executive compensation proposed by management to be included in our proxy statement and recommending that such disclosures be included in our annual report on Form 10-K and proxy statement.

The Compensation Committee does not delegate any of its responsibilities to other committees or persons. Participation by executive officers in the recommendation or determination of compensation for executive officers or directors is limited to (i) recommendations by our Chief Executive Officer to our Compensation Committee regarding the compensation of executive officers other than with respect to himself and (ii) our Chief Executive Officer’s participation in Board determinations of compensation for the non-employee directors.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is an officer or employee of the Company or has or had at any time any relationship with the Company that requires disclosure under Item 404 of Regulation S-K.

Audit Committee

The Company created an Audit Committee in August 2018. The Audit Committee operates under a written charter adopted by the Board of Directors and anticipates that it will shortly constitute such committee with G.E. Borstthe charter is available without charge on our website atwww.smithmidland.comunder the heading “Investors/Governance Docs”. Hard copies may also be obtained, without charge, by writing to our Secretary at Smith-Midland Corporation at 5119 Catlett Road, Midland, Virginia 22728. The Audit Committee held three meetings during the fiscal year ended December 31, 2020.

As of the fiscal year ended December 31, 2020, and as of the record date, the members of the Audit Committee consisted of Richard Gerhardt, its two independent directors.James Russell Bruner, and Wesley A. Taylor. Each member of the Audit Committee has been determined by the Board, which will be reviewed on an annual basis, to meet the standards for independence required of audit committee members by NASDAQ Marketplace and applicable SEC rules. The Board has determined that Mr. Bruner is an audit committee "financial expert,” within the meaning of Directorsapplicable SEC rules based upon his education, which he is a graduate of the University of Michigan Executive Program and Harvard Business School’s Advanced Management Program, and business-related experience.

The formal report of the Audit Committee is included in this proxy statement.

The Audit Committee oversees all accounting and financial reporting processes and the audit of the Company’s financial statements. The BoardAudit Committee is responsible for overseeing the quality and integrity of the Company’s financial statements and the qualifications, independence, selection and performance of the Company’s independent registered public accounting firm. The Board of Directors has determined that the Board does not currently have a person serving on it who qualifies as a Financial Expert as defined by the rules of the Securities and Exchange Commission. The Board of Directors does not believe that the addition of such an expert would add anything meaningful to the Company at this time given that its members have the sufficient knowledge and experience to fulfill the duties and obligations that an Audit Committee would have. The Company does not have an Audit Committee Charter, but plans to establish one shortly.

The Board of DirectorsAudit Committee has recommended that the audited financial statements for fiscal year ended December 31, 20172020 be included in the Company’s Annual Report on Form 10-K for the fiscal year then ended.

Leadership Structure

Currently, the Company separates the roles of Chairman of the Board and Chief Executive Officer. Rodney I. Smith who is Chairman of the Board, recently left his position as CEO of the Company and currently is employed by the Company.Board. The Company believes that Mr. Rodney I. Smith's history with the Company, as co-founder and former executive officer, makes him an appropriate person to provide Chairman oversight.

Risk Oversight

It is the responsibility of the Board to oversee the assets of the Company and to ensure that appropriate controls are in place to minimize risks associated with such assets. While the Board is tasked with the responsibility to detect potential high level risks, management is tasked with managing risk on a daily basis. Where possible, management, in conjunction with the Board, has defined high level risk controls to help mitigate the most significant risks to the Company.

Code of Ethics

Our Board of Directors hasThe Company adopted a Professional Codecode of Ethics as well as a Finance Code of Professional Conduct. The Professional Code of Ethics covers all employees of the Company and describes the policies and procedures for their ethical conduct. The Finance Code of Professional Conduct covers conduct in the practice of financial management and specifically relatesethics that applies to the Chief Executive Officer, the Chief Financial Officer, Accounting Manager, and other associatespersons performing similar functions. The Board of Directors approved the finance organization.code of ethics at their meeting on June 3, 2020. A copy may be obtained without charge by requesting one in writing from Secretary, Smith-Midland Corporation, P.O. Box 300, 5119 Catlett Road, Midland, VA 22728. The code of ethics is also posted on the Company's website at www.smithmidland.com on the home page.

Communications Between Stockholders and the Board of Directors

Stockholders and other interested parties wishing to communicate with members of the Board of Directors should send a letter to the Secretary of the Company with instructions as to which director(s) is to receive the communication. The Secretary will forward the written communication to each member of the Board of Directors identified by the stockholder or, if no individual director is identified, to all members of the Board of Directors.

Director Attendance at Annual Meeting

The Company has not in the past required members of the Board of Directors to attend each annual meeting of the stockholders because the formal meetings have been attended by very few stockholders, and have generally been brief and procedural in nature. All of the Company’s current directors attended the 20172020 Annual Meeting of stockholders.stockholders via teleconference. The Board will continue to monitor stockholder interest and attendance at future meetings and re-evaluate this policy as appropriate.

Director Compensation

All non-executive officer Directors whether employee or non-employee, receive $1,000$3,000 per meeting attended as compensation for their services as Directors, with an additional $3,000 annual fee for service as the chair of the Audit Committee, $3,000 annual fee for service as the chair of the Compensation Committee, and $6,000 annual fee for service as the Chairman of the Board.

The Company does not pay any additional compensation to directors who are reimbursedmembers of our management, but the Company reimburses all directors for out-of-pocket expenses incurred in connection with the performance ofattending Board and committee meetings or otherwise in their duties. For the twelve months ended December 31, 2017, total cash payments made to all Directors were $13,000.capacity as directors.

.

Director Compensation Table for 20172020

|

| | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($)(2) | | Option Awards ($) | | Non-Equity Incentive Plan Compen-sation | | Non- Qualified Deferred Compen- sation Earnings | | All Other Compen-sation | | Total ($) | |

| Rodney I. Smith | | 3,000 |

| | 10,900 |

| | — |

| | — |

| | — |

| | — |

| | 13,900 |

| (1) |

| Ashley B. Smith | | 3,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,000 |

| (1) |

| Wesley A. Taylor | | 2,000 |

| | 10,900 |

| | — |

| | — |

| | — |

| | — |

| | 12,900 |

| |

| G.E. Borst | | 3,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,000 |

| |

| Richard Gerhardt | | 2,000 |

| | — |

| | | | | | | | | | 2,000 |

| |

| |

(1) | Reflected in Summary Compensation Table below. |

| Name | Fees Earned or Paid in Cash ($) | | | Non-Equity Incentive Plan Compen-sation | Non- Qualified Deferred Compen- sation Earnings | | |

Rodney I. Smith (2)

| 15,000 | 13,470 | — | — | — | — | 28,470 |

Ashley B. Smith (3)

| — | — | — | — | — | — | — |

Wesley A. Taylor

| 9,000 | 35,920 | — | — | — | — | 44,920 |

Richard Gerhardt

| 12,000 | 35,920 | — | — | — | — | 47,920 |

James Russell Bruner

| 12,000 | 35,920 | — | — | — | — | 47,920 |

(1) Restricted shares granted vest, ratably, with 1/3 vesting immediately on grant, 1/3 one year following the grant, and 1/3 two years following the grant date. All shares were granted in December 2020.

(2) Does not include an annual royalty fee of $99,000 paid to Mr. Rodney I. Smith, and Mr. Wesley A. Taylor each received 2,000 shares of restricted stock granted pursuant to an employment agreement, payable as consideration for his assignment to the Company's 2016 Equity Incentive PlanCompany of all of his rights, title, and interest in certain patents.

(3) All compensation for additional compensation as directors. Mr. Ashley B. Smith Mr. G. E. "Nick" Borst and Mr. Richard Gerhardt each received 2,000 sharesis reported in Compensation of restricted stock granted pursuant to such Plan in December 2016.Executive Officers.

Executive Officers

The executive officers including the Chairman of the Board who continues to provide services to the Company as an employee, of the Company are:

| | | | | Director or Executive | | | | | | | |

| Name | | Age | | Officer Since | | Position | | | | | | |

| Rodney I. Smith | | 79 | | 1970 | | Chairman of the Board of Directors | |

| | | | | |

| Ashley B. Smith | | 55 | | 1994 | | Chief Executive Officer, President and Director | | 59 | | 1994 | | Chief Executive Officer, President, and Director |

| | | | | | | | | | | | |

| Adam J. Krick | | 33 | | 2018 | | Chief Financial Officer | | 36 | | 2018 | | Chief Financial Officer, Secretary, and Treasurer

|

| | | |

Adam J. Krick.Chief Financial Officer.Mr.Adam J. Krick has served as Chief Financial Officer of the Company since January 2018. Prior to becoming the Chief Financial Officer, Mr. Krick served as the Accounting Manager for the Company since 2014. Prior to joining the Company, Mr. Krick worked in public accounting focusing on tax and business consulting. Mr. Krick serves on the board as the Treasurer for Precast/Prestressed Concrete Institute Mid-Atlantic Chapter. Mr. Krick is a Certified Public Accountant and holds a Bachelor of Business Administration degree in Accounting from James Madison University.

For the biographiesbiography of Messrs. Rodney I. Smith andMr. Ashley B. Smith please see “Proposal No. 1—Election of Directors”.

Proposal No. 2

PROPOSAL TO RATIFY AND APPROVE THE SELECTION OF BDO USA, LLP

AS THE INDEPENDENT AUDITORS FOR THE COMPANY FOR THE YEAR ENDING

December 31, 20182021

The Company has selected BDO USA, LLP to serve as its independent registered public accounting firm for the year ending December 31, 2018.2021.

The Board unanimously recommends that Stockholders vote FOR the ratification of the selection of BDO USA, LLP as the independent auditors for the Company for the year endingDecember 31, 2018.

The Company does not currently have an Audit Committee, and accordingly, the following Audit Committee Report is being given by the entire Board of Directors, acting as the Audit Committee2021..

AUDIT COMMITTEE REPORT

The Company created an Audit Committee in August 2018. The following is the report of the Audit Committee of the Board of Directors in fulfilling its role asof the Company.

The Audit Committee is responsible for overseeing the integrity of the Company’s financial statements, the qualifications, independence, selection and compensation of the Company’s registered independent public accounting firm, and the internal control functions as they relate to the the preparation of the financial statements. Our Company currently does not have an

Among other things, the Audit Committee Charter, but plansreviews and discusses with management and with the Company’s independent registered public accounting firm the results of the Company’s year-end audit, including the audit report and audited financial statements. The members of the Audit Committee of the Board are presenting this report for the fiscal year ended December 31, 2020.

The Audit Committee acts pursuant to establish one shortly in conjuction witha written charter. The Audit Committee reviews and assesses the adequacy of its intentcharter annually. The Audit Committee held four meetings during the fiscal year ended December 31, 2020.

All members of the Audit Committee are independent directors, qualified to shortly constitute anserve on the Audit Committee.Committee pursuant to the applicable NASDAQ Marketplace Rules. The Audit Committee provides advice, counsel, and direction to management and the independent registered public accounting firm, based on the information it receives from them.

Management is responsible for the preparation, presentation and correctness of the Company’s financial statements, internal controls over financial reporting and procedures designed to assure compliance with generally accepted accounting procedures. The Company’s independent registered public accounting firm, BDO USA, LLP, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards in the United States of America and issuing a report thereon.

Management has represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed with management and BDO USA, LLP, the Company’s independent registered public accountants, the Company’s audited financial statements as of and for the year ended December 31, 2017.2020. The Audit Committee also discussed with BDO USA, LLP the matters required to be discussed by Statement on Auditing Standards No. 61 “Communications with Audit Committee”, as amended (AICPA, Professional Standards, Vol. 1 AU, Section 380), as adopted byapplicable requirements of the Public Company Accounting Oversight Board (PCAOB) in Rule 3200T.and the Securities and Exchange Commission. The Audit Committee has received the written disclosures and the letter from BDO USA, LLP required by applicable requirements of the PCAOB regarding BDO USA, LLP’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with BDO USA, LLP its independence. The Audit Committee has also discussed the compatibility of the provision of non-audit services with the independent auditor’s independence.

Management has also represented to the Audit Committee that it has completed an assessment of the effectiveness of the Company’s internal control over financial reporting, and the Audit Committee has reviewed and discussed with management and BDO USA, LLP the scope and results of their respective assessments of the Company’s internal control over financial reporting.The Audit Committee met at least once each quarter since its creation with BDO USA, LLP and management to review the Company’s interim financial results before the publication of the Company’s quarterly earnings press releases. The Audit Committee also intends to meet separately with BDO USA, LLP without the members of management present on at least an annual basis.

Based on the reportsreview and discussions described in this report, the Audit Committee recommended that the audited financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017,2020, for filing with the Securities and Exchange Commission.

The Board of Directors in its role as

The Audit Committee

Rodney I. Smith

Ashley B. Smith

Wesley A. Taylor

G.E. Borst | The Audit Committee: Richard Gerhardt James Russell Bruner Wesley A. Taylor |

AUDIT AND RELATED FEES

The aggregate fees billed for each of the two most recent fiscal years for professional services rendered by BDO USA, LLP, the principal accountant for the audit of the Company, for assurance and related services related to the audit; for tax compliance, tax advice, and tax planning; and for all other audited-related fees are shown in the table below.

Audit Fees. Fees charged as audit fees are for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s Forms 10-Q or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

Tax Fees. Tax fees are for professional services rendered by BDO USA, LLP for tax compliance, tax advice, and tax planning.

Audit-Related Fees. Fees paid to BDO USA, LLP for the audit of the Company's 401(k) benefit plan.

The Company currently does not havehas a separate standing Audit Committee, the entire BoardCommittee. All members of Directors acts as the Audit Committee. Messrs. Borst and GerhardtCommittee are considered to be independent when using the definition of the NASDAQ Marketplace Rules.

In accordance with applicable laws and regulations, the Board acting as the Audit Committee reviews and pre-approves any non-audit services to be performed by BDO USA, LLP to ensure that the work does not compromise their independence in performing their audit services. The Board acting as the Audit Committee generally also reviews and pre-approves all audits, audit related, tax and all other fees, as applicable. In some cases, pre-approval may be provided for up to a year and relates to a particular category or group of services and is subject to a specific budget and SEC rules.

| | | | 2017 | | 2016 | | |

| Audit Fees | $ | 186 |

| | $ | 123 |

| $175 | $155 |

| Tax Fees | 52 |

| | — |

| — | 30 |

| Audit-Related Fees | 10 |

| | 10 |

| — | 10 |

| Total Fees | $ | 248 |

| | $ | 133 |

| $175 | $195 |

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth, as of July 3, 2018,April 26, 2021, certain information concerning ownership of the Company’s Common Stock by (i) each person known by the Company, based solely on filings with the Securities and Exchange Commission, to own of record or be the beneficial owner of more than five percent (5%) of the Company’s Common Stock, (ii) named executive officers and Directors, and (iii) all Directors, and executive officers as a group. Except as otherwise indicated, the stockholders listed in the table have sole voting and investment powers with respect to the shares indicated.

|

| | | | | |

| | | Number of Shares Beneficially Owned | | Percentage of |

| Name and Address of Beneficial Owner (1) | | (2) | | Class |

| | | | | |

| Rodney I. Smith (1)(3)(4)(5) | | 684,798 |

| | 13.5% |

| | | | | |

| Ashley B. Smith (1)(3)(4)(6) | | 171,767 |

| | 3.4% |

| �� | | | | |

| Wesley A. Taylor (1)(7) | | 11,333 |

| | * |

| | | | | |

| G.E. Nick Borst (8) | | 83,000 |

| | 1.6% |

| | | . |

| | |

| Richard Gerhardt (9) | | 2,000 |

| | * |

| | | | | |

| William A. Kenter (1) | | 15,000 |

| | * |

| | | | | |

| Adam J. Krick (1)(10) | | 3,000 |

| | * |

| | | | | |

| Thompson Davis & Co. Inc. (11) | | 288,019 |

| | 5.7% |

| | | | | |

| Wax Asset Management, LLC (12) | | 618,412 |

| | 12.2% |

| | | | | |

| All directors and executive officers as a group (7 persons)(13) | | 970,898 |

| | 19.1% |

Name and Address of Beneficial Owner (1) | Number of Shares Beneficially Owned (2)

| |

| Rodney I. Smith (1)(3)(4)(5) | 686,469 | 13.2% |

| | | |

| Ashley B. Smith (1)(3)(4)(6) | 191,829 | 3.7% |

| | | |

| Wesley A. Taylor (1)(7) | 32,838 | * |

| | | |

| Richard Gerhardt (1)(7) | 6,171 | * |

| | | |

James Russell Bruner (1)(7)

| 10,171 | * |

| | | |

| Adam J. Krick (1)(8) | 10,236 | * |

| | | |

| Thompson Davis & Co., Inc. (9) | 769,643 | 14.8% |

| | | |

Wax Asset Management, LLC (10)

| 410,880 | 7.9% |

| | | |

| All directors and executive officers as a group (6 persons)(11) | 937,714 | 17.9% |

* Less than 1%

(1) The address for each of Messrs. Rodney I. Smith, Ashley B. Smith, Wesley A. Taylor, William A. Kenter,Richard Gerhardt, James Russell Bruner, and Adam J. Krick is c/o Smith-Midland Corporation, 5119 Catlett Road, Midland, Virginia 22728.

(2) Pursuant to the rules and regulations of the Securities and Exchange Commission, shares of Common Stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. The table does not include performance-based restricted stock grants under the Company's 2016 Equity Incentive Plan, as the number of shares to be awarded is not determinable and the recipients do not have the right to vote or other elements of beneficial ownership until vesting; included are restricted shares subject solely to continued services as a director or employee.

(3) Ashley B. Smith is the son of Rodney I. Smith. Each of Rodney I. Smith and Ashley B. Smith disclaims beneficial ownership of the other’s shares of Common Stock.

(4) Does not include aggregate of 78,883116,621 shares of Common Stock held by Matthew Smith and Roderick Smith. Matthew Smith and Roderick Smith are sons of Rodney I. Smith, and brothers of Ashley B. Smith. Also, does not include shares held by Merry Robin Bachetti, sister of Rodney I. Smith and aunt of Ashley B. Smith, for which each of Rodney I. Smith and Ashley B. Smith disclaims beneficial ownership.

(5) Does not include 2,500 shares of Common Stock held by Hazel Bowling, former wife of Rodney I. Smith, and mother of Mr. Smith’s children. Mr. Smith disclaims beneficial ownership of the shares held by Hazel Bowling. Includes 28,0001,171 unvested restricted shares granted pursuant to the Company's 2016 Equity Incentive Plan, which shares vest ratably, on an annual basis, over a remaining two year period.Plan.

(6) Includes 21,3338,254 unvested restricted shares granted pursuant to the Company's 2016 Equity Incentive Plan which shares vest ratably, on an annual basis, over a remaining two year period..

(7) Includes 11,3332,838 unvested restricted shares granted pursuant to the Company's 2016 Equity Incentive Plan which shares vest ratably, on an annual basis, over a remaining two year period..

(8) Address of holder is P.O. Box 351, Ophelia, VA 22530. Includes 1,3334,691 unvested restricted shares granted pursuant to the Company's 2016 Equity Incentive Plan which shares vest ratably, on an annual basis, over a remaining two year vesting period..

(9) Address of holder is 8305 Old Dumfries Road, Catlett, VA 20119. Includes 1,333 restricted shares granted pursuant to the Company's 2016 Equity Incentive Plan, which shares vest ratably, on an annual basis, over a remaining two year vesting period.

(10) Includes 2,500 restricted shares granted in January 2018 pursuant to the Company's 2016 Equity Incentive Plan, which shares vested in full immediately on the grant date pursuant to the 2016 Equity Incentive Plan. Includes 333 restricted shares granted pursuant to the Company's 2016 Equity Incentive Plan, which shares vest ratably, on an annual basis, over a remaining two year period.

(11) Address of holder is 15 S. 5th Street, Richmond, VA 23219.

(12)(10) Address of holder is 44 Cherry Street,Lane, Madison, CT 06830. 06443.

(13) (11) Includes 63,66522,630 unvested restricted shares for all directors and executive officers as a group.granted pursuant to the Company's 2016 Equity Incentive Plan.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information as of December 31, 20172020 regarding the Company's equity compensation plans:

|

| | | | | | |

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans |

| Equity compensation plans approved by security holders (1) | 10,333.00 |

| 1.21 |

| — |

|

| Equity compensation plans not approved by security holders | — |

| — |

| 225,000 |

|

| Total | 10,333 |

| 1.21 |

| 225,000 |

|

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans |

Equity compensation plans approved by security holders

| — | — | — |

Equity compensation plans not approved by security holders (1)

| — | — | 170,334 |

| Total | — | — | 170,334 |

(1) The 500,000 options, available for issuance under the 2008 Stock Option Plan of the Company have been canceled by the Company's Board of Directors and replaced by the Smith-Midland 2016 Equity Incentive Plan (the "Equity Incentive Plan"), which has a balance of 225,000170,334 shares of stock unissued and available for award at December 31, 2017.2020.

On October 13, 2016 the Company's Board of Directors adopted the 2016 Equity Incentive Plan.Plan (the "Equity Incentive Plan"). Employees, directors and consultants of the Company are eligible to participate in the Equity Incentive Plan. The Equity Incentive Plan is administered by the Compensation Committee of the Board of Directors or the full Board during such times as no committee is appointed by the Board or during such times as the Board is acting in lieu of the committee (the "Committee"). The Equity incentiveIncentive Plan provides for the grant of equity-based compensation in the form of restricted stock, restricted stock units, performance shares, performance cash and other share-based awards. The Committee has the authority to determine the type of award, as well as the amount, terms and conditions of each award, under the Equity Incentive Plan subject to the limitations and other provisions of the Equity Incentive Plan. An aggregate of 400,000 shares of Common Stock, par value $.01 per share, were authorized for issuance under the Equity Incentive Plan, subject to adjustment for stock splits, dividends, distributions, recapitalizations and other similar transactions or events, of which amount 223,833170,334 remains available for issuance. If any shares subject to an award are forfeited, expire, or otherwise terminate without issuance of such shares, such shares shall, to the extent of such forfeiture, expiration, or termination, again be available for issuance under the Equity Incentive Plan.

Compensation of Executive Officers

The following table sets forth the compensation paid by the Company for services rendered for 20172020 and 20162019 to the principal executive officer andas well as the Company’s two most highly compensatedother executive officers other thanofficer of the principal executive officerCompany (the “named executive officers”) as of the end of 2017:2020:

Summary Compensation Table

|

| | | | | | | | | | | | | |

| Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($) | Option Awards ($) | Non-Qualified Deferred Compensation Earning ($) | All Other Compen- sation ($) | Total ($) |

| Rodney I. Smith | 2017 | 116,774 |

| 64,230 |

| 228,900 |

| | | 102,000 |

| 511,904 |

|

| Chief Executive Officer | 2016 | 108,788 |

| 4,375 |

| | | | 102,000 |

| 215,163 |

|

| and Chairman of the | | | | | | | |

|

|

| Board (3)(4) | | | | | | | | |

| | | | | | | | | |

| Ashley B. Smith | 2017 | 201,994 |

| 59,808 |

| | | | 3,000 |

| 264,802 |

|

| President (4)(5) | 2016 | 192,423 |

| 3,385 |

| 158,400 |

| | | 3,000 |

| 357,208 |

|

| | | | | | | | | |

| William A. Kenter | 2017 | 124,834 |

| 28,284 |

| 81,750 |

| | | — |

| 234,868 |

|

| Chief Financial Officer (6) | 2016 | 112,357 |

| 2,300 |

| | | | — |

| 114,657 |

|

| | | | | | | | |

|

|

Name and Principal Position | | | | | | All Other Compensation ($) | |

| Ashley B. Smith | | 2020 | 313,666 | 133,894 | 89,800 | — | 537,360 |

| President and Chief Executive Officer (3) | | 2019 | 275,100 | 152,420 | — | — | 427,520 |

| | | | |

Adam J. Krick

| | 2020 | 168,468 | 34,687 | 53,880 | — | 257,035 |

| Chief Financial Officer (4) | | 2019

| 144,569 | 55,741 | — | — | 200,310 |

(1) Represents salaries paid in 20172020 and 20162019 for services provided by each named executive officer serving in the capacity listed.

(2) Represents amounts paid for annual performance-based bonus related to operations for the prior year.

(3) Mr. Rodney Smith was paid $99,000 in each of 2017 and 2016, which is included in the column titled “All Other Compensation”, for royalty payments due under his employment contract with the Company, which is more fully described in the following section titled “Employment Contracts and Termination of Employment and Change in Control Arrangements”. In addition, Mr. Rodney Smith received director’s compensation in the amount of $3,000 for the years 2017 and 2016. Includes under Stock Awards, 42,000 restricted shares granted to Mr. Smith in January 2017, vesting ratably, on an annual basis, over a three year vesting period. The value of the common stock shares at the grant date was $228,900.

(4) In May 2018, Ashley B. Smith replaced Rodney I. Smith as Chief Executive Officer of the Company. Mr. Rodney I. Smith remained as Chairman of the Board and is currently an employee of the Company.

(5) Mr. Ashley Smith received director’s compensation in the amount of $3,000 for each of the years 2017 and 2016. Mr. Ashley Smith was granted 32,000 shares of restricted common stock on December 14, 2016, pursuant to the Company's 2016 Equity Incentive Plan. The grants vest ratably, on an annual basis, over a three year vesting period. The value of the common stock shares at the grant date was $158,400.

(6) Includes 15,00010,000 restricted shares granted in January 2017December 2020 pursuant to the Company's 2016 Equity Incentive Plan, which 3,333 shares vested in full immediately on the grant date, 3,333 shares vest one year following the grant date, and the remaining 3,334 vest two years following the grant date. The value of the common stock shares at the grant date was $81,750. Mr. Kenter retired as Chief Financial Officer$89,800.

(4) Includes 6,000 restricted shares granted in December 2020 pursuant to the Company's 2016 Equity Incentive Plan, which 2,000 shares vested in full immediately on the grant date, 2,000 shares vest one year following the grant date, and the remaining 2,000 vest two years following the grant date. The value of the Company as of December 31, 2017; he continues employment on a part-time basis in an advisory role.common stock shares at the grant date was $53,880.

Outstanding Equity Awards At Fiscal Year-End

The following table sets forth information for the named executive officers regarding any common share purchase options, stock awards or equity incentive plan awards that were outstanding as of December 31, 2017.2020.

Outstanding Equity Awards at Fiscal Year-End

| | | Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisa-ble | | Option Exercise Price ($/Sh) | | Option Expiration Date | Number of Shares or Units of Stock that have not Vested (#)(1) | Market Value of Shares or Units of Stock that have not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that have not Vested ($) | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($/Sh) | | Number of Shares or Units of Stock that have not Vested (#) | Market Value of Shares or Units of Stock that have not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#)(1) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that have not Vested ($)(1) |

| Rodney I. Smith | | — |

| | — |

| | — |

| | — |

| 42,000 |

| 228,900 |

| — |

| — |

| |

| Ashley B. Smith | | — |

| | — |

| | — |

| | — |

| 21,333 |

| 105,598 |

| — |

| — |

| — | — | — | 6,667 | 63,003 |

| William A. Kenter | | — |

| | — |

| | — |

| | — |

| — |

| — |

| — |

| — |

| |

Adam J. Krick

| | — | — | — | 4,000 | 37,800 |

| TOTAL | | — |

| | — |

| | |

| | | 63,333 |

| 334,498 |

| — |

| — |

| — | | — | 10,667 | 100,803 |

(1) Restricted shares granted vest, ratably, on an annual basis, over threewith 1/3 vesting immediately upon grant, 1/3 one year following the grant date, and 1/3 two years fromfollowing the date of grant.grant date. All shares were granted in December 2020.

Employment Contracts and Termination of Employment and Change in Control Arrangements.

The Company has entered into a four-yearan employment agreement (the “Employment Agreement”), dated as of November 11, 2020, with Ashley B. Smith pursuant to which Mr. Smith serves as the Chief Executive Officer and President of the Company.

The Employment Agreement is for a term of three years commencing on November 11, 2020 (the “Effective Date”) through and including November 10, 2023 (the “Employment Period”), subject to early termination as provided therein. Commencing on the first anniversary of the Effective Date, and on each annual anniversary thereafter (such date and each annual anniversary thereof shall be hereinafter referred to as the “Renewal Date”), unless previously terminated, the Employment Period shall be automatically extended so as to terminate three years from such Renewal Date, unless at least 180 days prior to the Renewal Date the Company shall give notice to Mr. Smith, or Mr. Smith shall give notice to the Company, that the Employment Period shall not be so extended. The Employment Agreement provides for a base salary (“Base Salary”) of $300,000 per year,with Rodney I.an increase of no less than 3% per annum. Mr. Smith’s Base Salary shall be reviewed annually by the Compensation Committee of the Board of Directors (the “Compensation Committee”) pursuant to its normal performance review policies for senior executives and may be increased but not decreased. Mr. Smith is also entitled to receive an annual bonus incentive payment (the “Incentive Bonus Payment”) as determined by the Compensation Committee in its discretion and, if applicable, in accordance with the terms of any applicable incentive plan of the Company and subject to the achievement of any performance goals established by the Compensation Committee with respect to such fiscal year. Mr. Smith shall also be eligible to participate in long term cash and equity incentive plans and programs applicable to senior officers of the Company.

The Employment Agreement further provides that if Mr. Smith is terminated by the Company without Cause or leaves the Company with Good Reason (generally, for material diminution in Mr. Smith’s Base Salary, target Incentive Bonus Payment, or position, authority, duties or responsibilities, relocation of Mr. Smith’s principal place of business to a location more than 30 miles from Mr. Smith’s principal place of business or material breach by the Company of the Employment Agreement), Mr. Smith shall be paid his Base Salary pro-rated through the date of termination, any Incentive Bonus Payment earned for a prior award period but not yet paid, any accrued vacation or paid time off to the extent not paid and unreimbursed business expenses (collectively, the “Accrued Obligations”) and any other amounts or benefits required to be paid or provided or which Mr. Smith is eligible to receive through the date of termination (the “Other Benefits”). In the event such termination occurs within two years following a change of control, Mr. Smith shall also be entitled to a lump sum payment equal to the product of (a) 2.99 multiplied by (b) the sum of Mr. Smith’s Base Salary in effect prior to such termination and the Target Incentive Bonus Payment for the year of termination of employment (or, if higher, or if no Target Incentive Bonus Payment has been established for such year, the Incentive Bonus Payment for the year prior to the date of termination). In the event such termination does not occur within two years following a change of control, Mr. Smith shall also be entitled to receive an aggregate amount, payable in equal monthly cash payments over a period of 24 months, equal to the product of (a) 2.0 multiplied by (b) the sum of Mr. Smith’s Base Salary in effect prior to such termination and the Target Incentive Bonus Payment for the year of termination of employment (or, if higher, or if no Target Incentive Bonus Payment has been established for such year, the Incentive Bonus Payment for the year prior to the date of termination). The Company shall also continue to provide Mr. Smith and his dependents with health and other insurance coverage for 24 months following such termination.

If Mr. Smith’s employment is terminated for Cause, because Mr. Smith voluntarily resigns without Good Reason or due to the death of Mr. Smith, Mr. Smith, or his estate, as applicable, shall be paid the Accrued Obligations and the Other Benefits. If Mr. Smith’s employment is terminated due to disability, Mr. Smith shall be paid his Base Salary in equal monthly payments for one year commencing on the date of termination, the Target Incentive Bonus Payment for the year of termination of employment (or, if no Target Incentive Bonus Payment has been established for such year, the Incentive Bonus Payment for the year prior to the date of termination), the Accrued Obligations and the Other Benefits.

Mr. Smith is also subject to non-competition and non-solicitation restrictions during the Employment Period and for a period of two years thereafter.

The Company has an employment agreement with its former Chief Executive Officer and current Chairman of the Board, effectiveRodney I. Smith. While Mr. Smith ceased providing services as of September 30, 2002. The term of employment automatically renews commencing onChief Executive Officer in May 2018, he received his salary, pursuant to the date one year after the effective date, and on an annual basis thereafter, for an additional one year, unless earlier terminated or not renewed as provided for therein. The agreement provides for an annual base salary of $99,000 (“Base Salary”), which will be reviewed at least annually and adjusted from time to time at the determinationterms of the Board of Directors. Itagreement, through September 2019. The agreement also provides for an annual royalty fee of $99,000 payable as consideration for Mr. Smith’shis assignment to the Company of all of his rights, title and interest in and to the Patents (as defined in the agreement).certain patents. Payment of the royalty continues only for as long as the Company is using the inventions underlying the Patents.patents. Mr. Smith also received compensation from the Company for his services as a Director and Chairman of the Board. Mr. Smith is also entitled to performance-based bonus as determined by the Board each calendar year.

Mr. Smith’s employment agreement provides further that if Mr. Smith (i) voluntarily leaves the employ of the Company within six months of his becoming aware of a Change of Control (as defined in the agreement) of the Company, then he shall be entitled to receive a lump sum amount equal to three times the five-year average of his combined total annual compensation, which includes the Base Salary and bonus, less one dollar ($1.00), and certain other unpaid accrued amounts as of the date of his termination, or (ii) is terminated by the Company without Cause (as defined in the agreement) or leaves the Company with Good Reason (as defined in the agreement), Mr. Smith shall be entitled to a lump sum payment equal to three times the combined Base Salary and bonus paid during the immediately preceding calendar year, and such other unpaid accrued amounts. In any of such cases, the Company will provide Mr. Smith with certain Company fringe benefits for two years, subject to certain conditions as provided for in the agreement, and all of Mr. Smith’s unvested options to purchase Company stock shall become fully vested and exercisable on the date of termination. Mr. Smith will be entitled to exercise all such options for three years from the date of termination. The Company will have no further obligations to Mr. Smith, other thancurrently being compensated with respect to royalty payments in accordance with the payment of royalties.employment agreement.